10 Commandments for Efficient and Sustainable Community Building - Part 2 of 2

Table of Contents

Part 1

- 3. Ten Commandments for Efficient and Sustainable Community Building

- 3.1. Haters gonna hate : Do not spend too much energy on bad sentiments

- 3.2. Quality matters : It is better to aim high and hit one, than to aim low and hit twenty

- 3.3. A picture is worth a thousand words : Visual appeals are your best friend for marketing (especially when you are building Gaming, or Game-Fi projects!)

- 3.4. Chicken first, or egg first : Distinguish between transitory hype due to price rallies and sentiment improvements due to fundamental growth

Part 2

- 3. Ten Commandments for Efficient and Sustainable Community Building

- 3.5. Whales are heavy : Focus more on the retail community than on whales for long term sentiment growth in projects

- 3.6. Ride a tide : Going with the trend gives an edge in customer acquisition

- 3.7. Broke but woke : Despite the lower market capitalization than DeFi, Gaming gets more attention

- 3.8. Airdrops are temporary, listings are permanent : Pair your airdrops with listings to maximize the effectiveness

- 3.9. One-size-fits-one : Each sector has different strategies to strengthen a community

- 3.10. Somebody gets tired of loving you : Do not rely on repetitive announcements of a similar kind; mix a single great news with diverse okay news

Important Disclaimer

(Continued from Part 1)

3. Ten Commandments for Efficient and Sustainable Community Building

3.5. Whales are heavy

The data saith, “Thou shalt turn many to thy house instead of the rich, and thou shalt shine.” (or in modern language, “Focus more on the retail community than on whales for long term sentiment growth in projects.”)

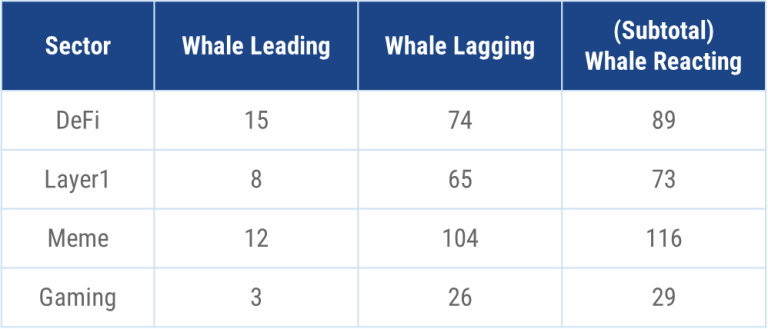

We checked for the order of signal arrivals on each news to see whether whales are indeed forerunning the retails.

Table 4 – Whale Reaction Count on News Announcements

Contrary to a common belief, in most cases whales are concurrent or late to news, and rarely are preceding the sentiment moves. This observation tells us that whales generally act separately from news announcements, from which we can deduce that the recipients of news are mainly retail users. Therefore, it may be better off to focus on the retail communities when we design marketing strategies based on news announcements.

“Whales are accumulating” is a frequently used meme in the crypto industry to measure soundness of communities, but we should actually focus more on the overall community, or the “retail communities” instead, to build long-lasting communities.

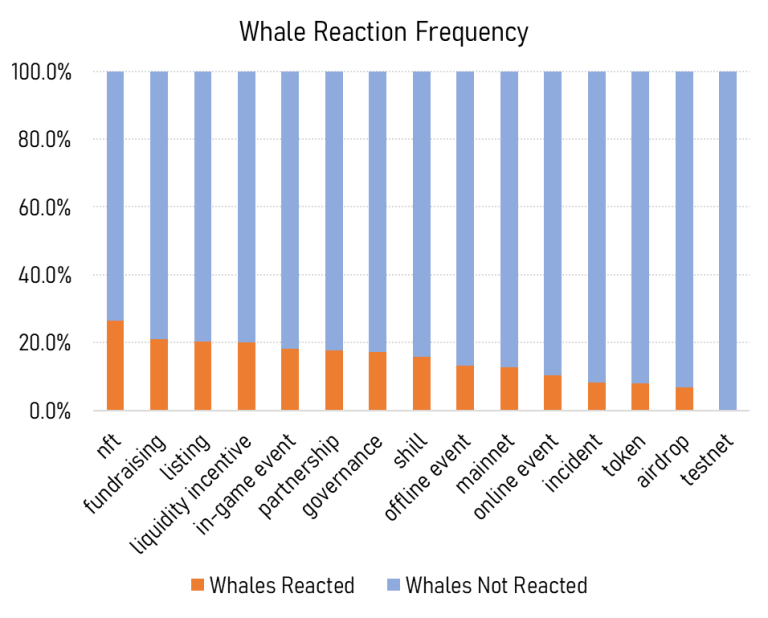

Figure 11 – Whale Reaction Frequency out of Total News Count

If we analyze whale moves by news categories, we can learn that whales do not react to most news, but they are the most likely to recognize NFT mints. Considering that projects usually price NFTs in their own tokens, and whales, by definition, hold many tokens, there is nothing to be surprised here.

One possible shortcoming from the analysis above is that our dataset comprises only large cap tokens. Therefore, our sample dataset is prone to be biased towards tokens with a firm user base, of which on-chain data is likely to be monitored closely by retail communities. As the web3 industry further matures, we hope to see accumulation of data on small to mid cap tokens to extend our knowledge.

3.6. Ride a tide

The data saith, “Follow thou me.” (or in modern language, “Going with the trend can give an edge in customer acquisition.”)

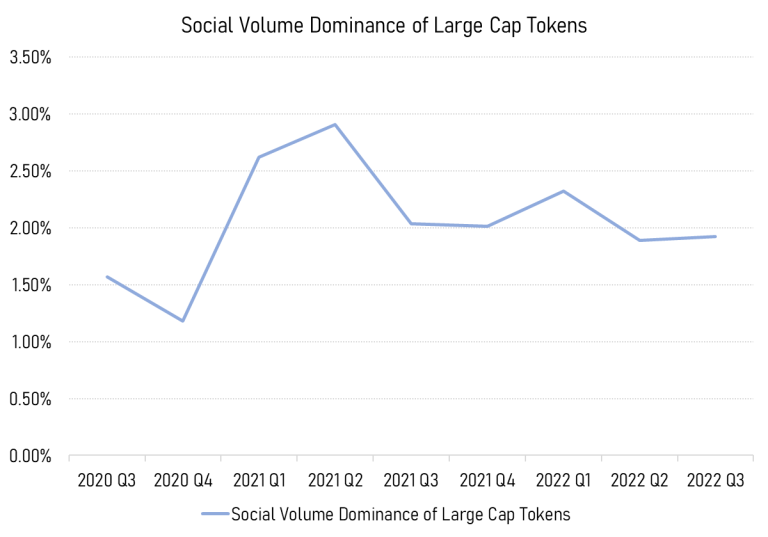

Figure 12 – Quarterly Sums of Daily Social Volume Dominance per News Category

Figure 13 – Quarterly Mean Social Volume Dominance of the Selected Tokens

3.7. Broke, but woke

The data saith, “Thou shalt play games.” (or in modern language, “Despite the lower market capitalization than DeFi, Gaming sector gets more attention.”)

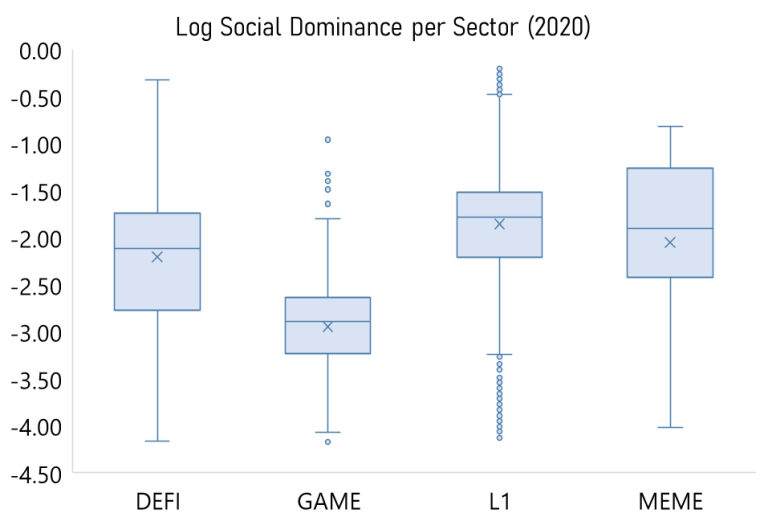

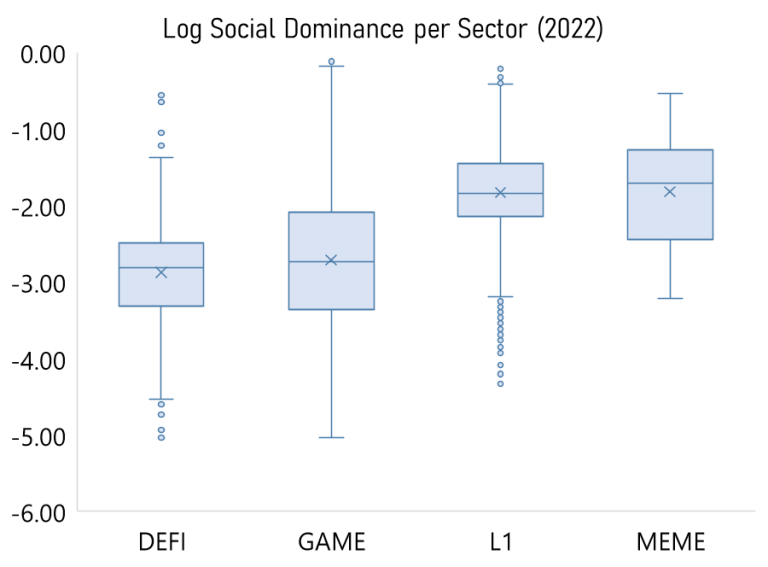

Figure 13 – Social Volume Dominance per Sector 2020

Figure 14 – Social Volume Dominance per Sector 2022

However, aggregate market cap of DeFi to Gaming is still at 2:1 as of Oct 2022. The market speculates the Gaming sector to be the next big thing in crypto, but money is yet to flow from DeFi into Gaming, perhaps due to a lack of ‘killer products.’

When all eyes are on Gaming, it is a great time to build one and take it all. Even if the market trend changes, we are searching for more metrics that could potentially visualize the trend, so you don’t have to.

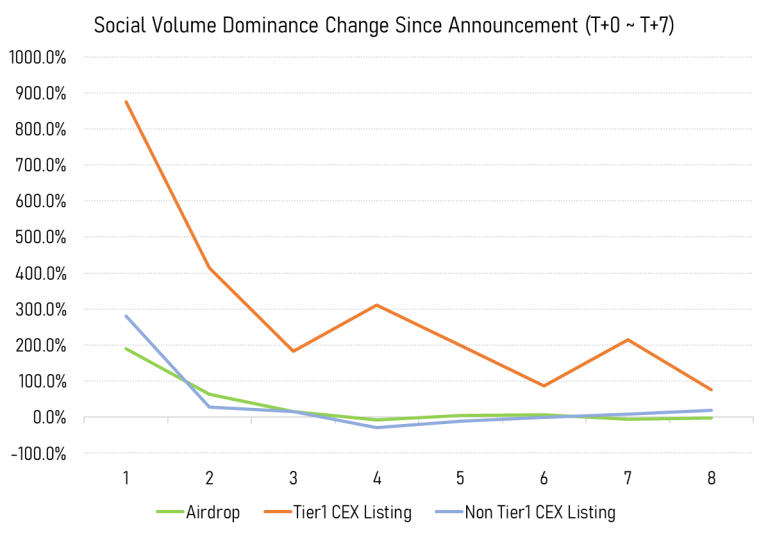

3.8. Airdrops are temporary, quality listings are permanent

The data saith, “Thou shall live by the righteous listings.” (or in modern language, “People forget easily about airdrops, but they remember quality listings.”)

Figure 15 – Social Volume Dominance Change to Pre-Announcement

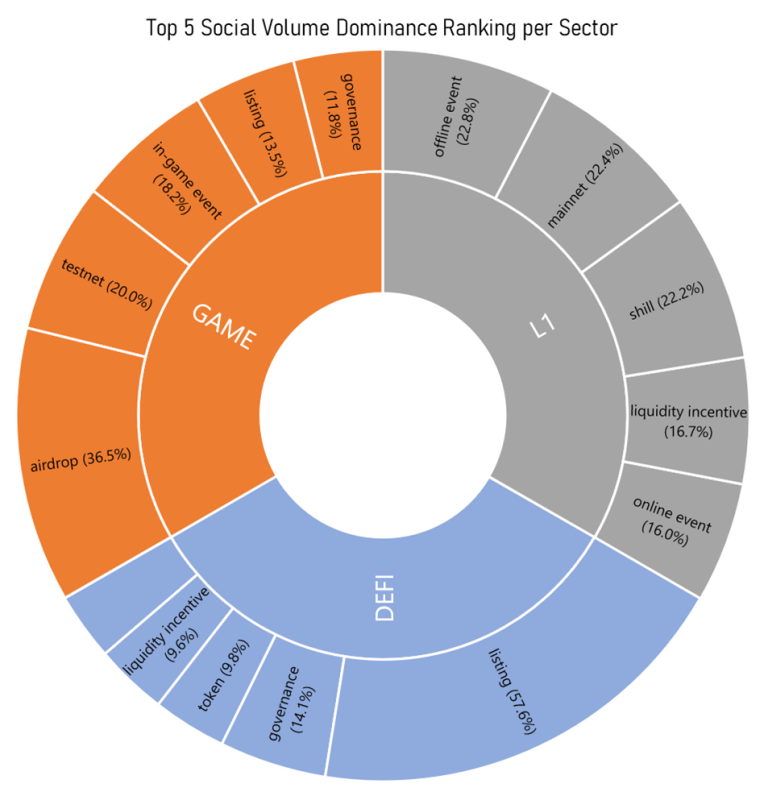

3.9. One-size-fits-one

The data saith, “Thou shalt have differing plans to prosper for each part.” (or in modern language, “Each sector has different strategies to strengthen a community.”)

Figure 16 – Top 5 Social Volume Dominance Ranking per Sector

L1s and DeFi projects have a good reason to get high valuations or get substantial funding, but Gaming projects only need as much as they can continue to operate. Liquidity incentive events brew significant sentiment in L1s and DeFi projects, thus it is important to bring in more funds to the ecosystem, or to the protocols to drive more consumers in. However, gamers have much lower appetites for money; they embrace events and playable builds instead, as we mentioned in Commandment 3.

One thing to note here is that offline events are usually fruitless in terms of market attention unless for L1s, implying that the market is still revolving around L1 projects. Other sectors might not have enough capital, or enough communities, to draw in enough visitors to host offline events.

3.10. Somebody gets tired of loving you

The data saith, “Thou shalt not call the same name again and again.” (or in modern language, “Do not rely on repetitive announcements of a similar kind. Mix a single great news with diverse okay news.”)

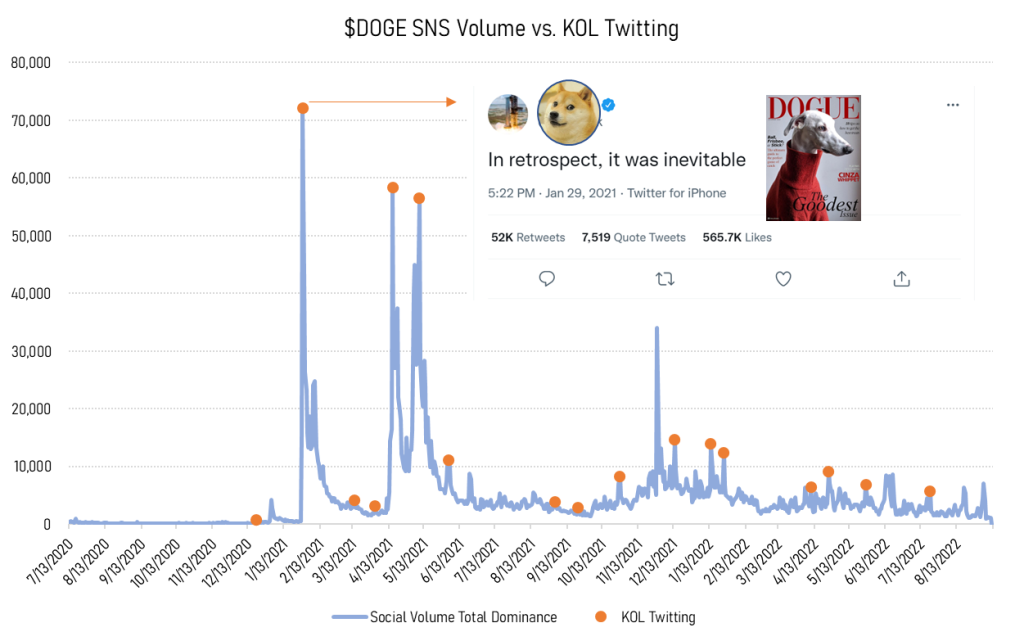

We saved the lightest for the last. We will zoom in to Dogecoin ($DOGE), the most beloved meme-based cryptocurrency, as it offers some fresh data points in many ways—it is a ticker led by a single KOL, but that KOL is nowhere near to being a founder or an owner; Dogecoin is also entirely driven by meme values.

Even the greatest news has a diminishing marginal sentiment response. We can easily map Tweets from a KOL onto sentiment dominance of Dogecoin in social media (Figure 17).

The initial and the followup Tweets from the KOL on Dec 20 2020 and Jan 29 2021 respectively, and the following price pump literally drove SNS sentiment on Dogecoin to Mars, but subsequent Tweets from Elon were just not as effective as the first two; even the KOL urging to accept $DOGE as a viable payment were accepted at a lesser degree of cheers from the public.

Figure 17 – Dogecoin Social Volume Dominance with KOL Tweets

4. Key Takeaways and Concluding Remarks

- – To do an airdrop, choose a fairdrop over a stakedrop for building a community.

- – An airdrop or a non-Tier 1 listing may attract attention, but they are not effective in retention.

- – Gaming projects should consistently share their visual productions, while L1 or DeFi projects should drop a partnership bomb once in a while.

Although we boastfully named these insights ‘Commandments’, they are by no means absolute; we recommend taking our advice with a grain of salt when applying them to actual business opportunities.

We chose community building as the foundational topic as it is the topic founders are mostly concerned with due to its ambiguity in measurement and uniqueness to Web 3. How can we define a ‘good community,’ and how can we measure the contribution of each marketing strategy to building the community? Our paper might not be a comprehensive cookbook, but we hope it could be a primitive starting point to develop ideas on.

Our thematic research paper series will keep on providing deep, data-driven insights on key questions from founders in the crypto industry. Please stay tuned for our next release.

For the curiosities we have not addressed in this paper, for example:

- – Is there any specific news category that is more likely to only trigger positive sentiment?

- – How can a project conduct multiple NFT mints and not ruin consumer sentiment?

Appendix : Methodology

Data Selection

- – Market capitalization

- – Data history and completeness

- – Sector representativeness and first-of-its-kind status

- – Community diversity

Data Conversion

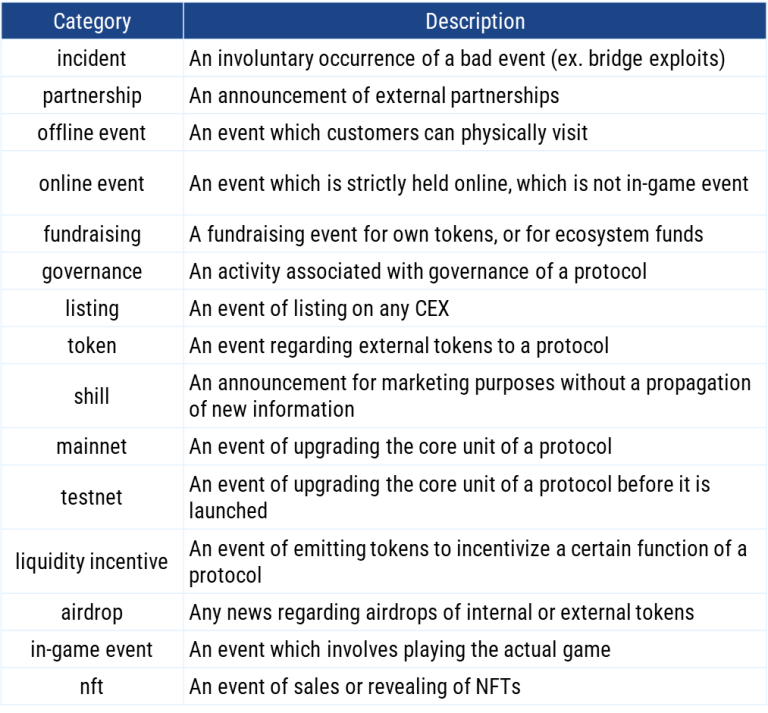

Table 1 – News Category Classification Criteria

We categorized news from official announcements as shown in Table 1, and for each news, we assigned a ‘significant factor,’ which represents the significance of the news. If a news article is classified as ‘significant,’ it falls under the ‘quality’ category as mentioned in Commandment 2, and falls under the ‘Tier 1 CEX’ category as mentioned in Commandment 2 and 8. If a news article is not classified as ‘significant,’ it falls under the ‘mediocre’ category as mentioned in Commandment 2 and 4.

A significant factor is assigned 1 if the news involves publicly listed companies or tokens with more than $1B market capitalization at the time of writing, top ranked global and local CEXes in terms of net effective trading volume and user density, upgrades to the core unit that is generally accepted to be of importance (ex. Ethereum’s transition to Proof-of-Stake), or fundraises solely for the protocol and/or ecosystem fund amounting to more than $100M.

Significant News

- A fundraising of more than $100M

- A partnership with a publicly listed company or a crypto project with a market capitalization higher than $1B

- Listing on one of Top 3 CEXes based on trading volume and reputation

Price rallies/sell-offs

(End of this paper)