10 Commandments for Efficient and Sustainable Community Building - Part 1 of 2

Table of Contents

Part 1

- 3. Ten Commandments for Efficient and Sustainable Community Building

- 3.1. Haters gonna hate : Do not spend too much energy on bad sentiments

- 3.2. Quality matters : It is better to aim high and hit one, than to aim low and hit twenty

- 3.3. A picture is worth a thousand words : Visual appeals are your best friend for marketing (especially when you are building Gaming, or Game-Fi projects!)

- 3.4. Chicken first, or egg first : Distinguish between transitory hype due to price rallies and sentiment improvements due to fundamental growth

Part 2

- 3. Ten Commandments for Efficient and Sustainable Community Building

- 3.5. Whales are heavy : Focus more on the retail community than on whales for long term sentiment growth in projects

- 3.6. Ride a tide : Going with the trend gives an edge in customer acquisition

- 3.7. Broke but woke : Despite the lower market capitalization than DeFi, Gaming gets more attention

- 3.8. Airdrops are temporary, listings are permanent : Pair your airdrops with listings to maximize the effectiveness

- 3.9. One-size-fits-one : Each sector has different strategies to strengthen a community

- 3.10. Somebody gets tired of loving you : Do not rely on repetitive announcements of a similar kind; mix a single great news with diverse okay news

Important Disclaimer

1. Introduction

2. Data Overview

Data Specification

- – Market capitalization

- – Data history and completeness

- – Sector representativeness, and first-of-its-kind status

- – Community diversity

We then subdivided the selected tickers into four sectors: L1, DeFi, Gaming, and Meme, to check for contingent sectoral characteristics.

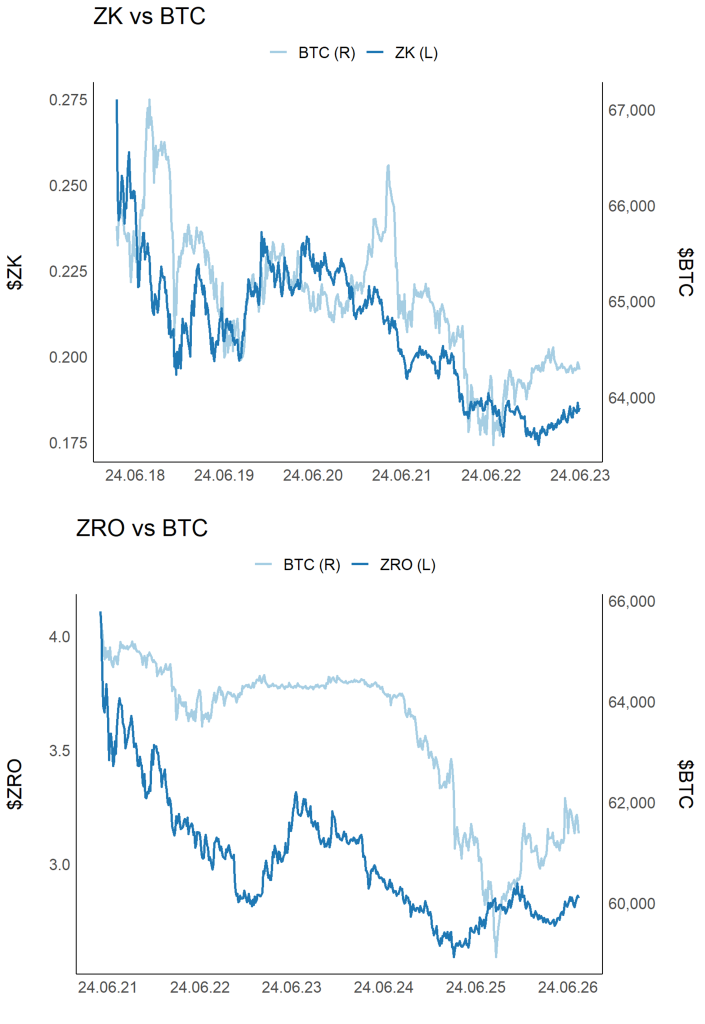

We gathered five data columns for each ticker: positive social volume, negative social volume, total social volume, whale transactions, and active addresses. Numbers are converted to relative terms as in ‘social dominance’ instead of ‘social volume’ for normalization, so no raw data is used in this paper. Our processed time-series data looks like Figure 1.

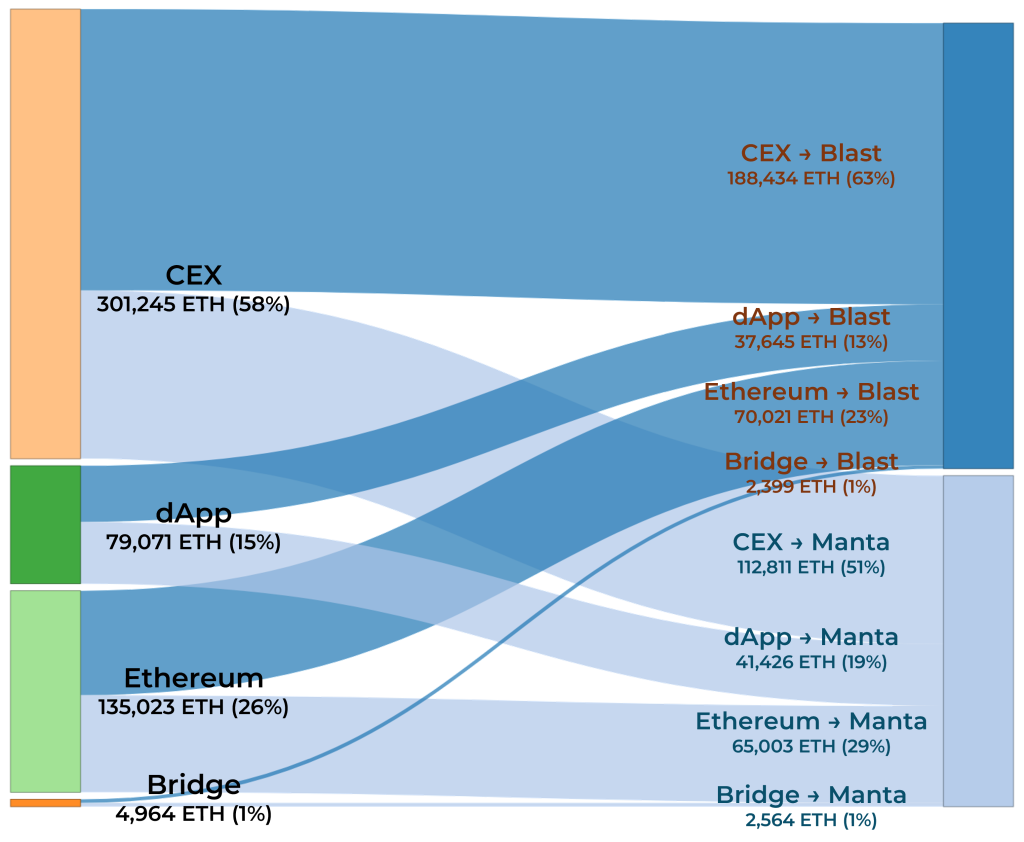

Circles in the graph below identify local maxima in negative social dominance, to which we assigned corresponding news based on the news categorization criteria (Table 1). For scraping news data, we only used official announcements from the respective foundations or from key figures as news.

We processed data for all five columns accordingly. Our final sample dataset comprises 21 tickers over 4752 days with 2936 signals paired with 2010 news announcements (Table 2).

Figure 1 – Time-series Data of Adjusted Social Volume for a Ticker

Table 1 – News Category CLassification Criteria

Table 2 – Data Summary

FAQ Specification

3. Ten Commandments for Efficient and Sustainable Community Building

3.1. Haters gonna hate

The data saith, “Thou shalt not be cast into disarray by the voices of the doubters.” (or in modern language, “Do not spend too much energy on bad sentiments.”)

*a local maxima in sentiment dominance; refer to Figure 1

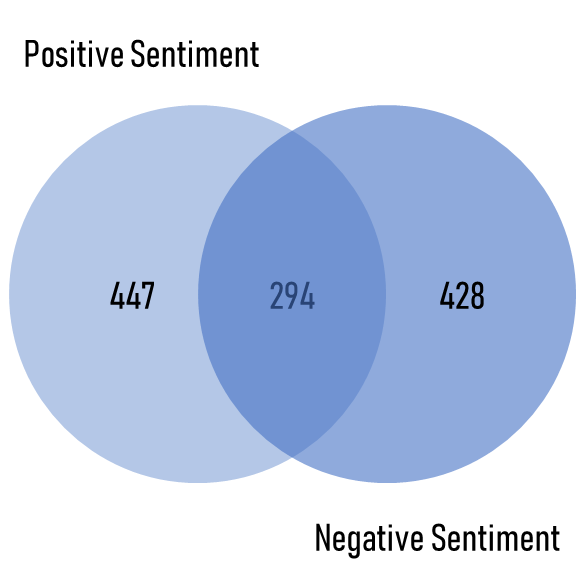

As visible from Figure 2, 39.7% of positive signals coincided with negative signals, indicating that two opposite responses often overlap, regardless of the source news being essentially bullish to projects or not.

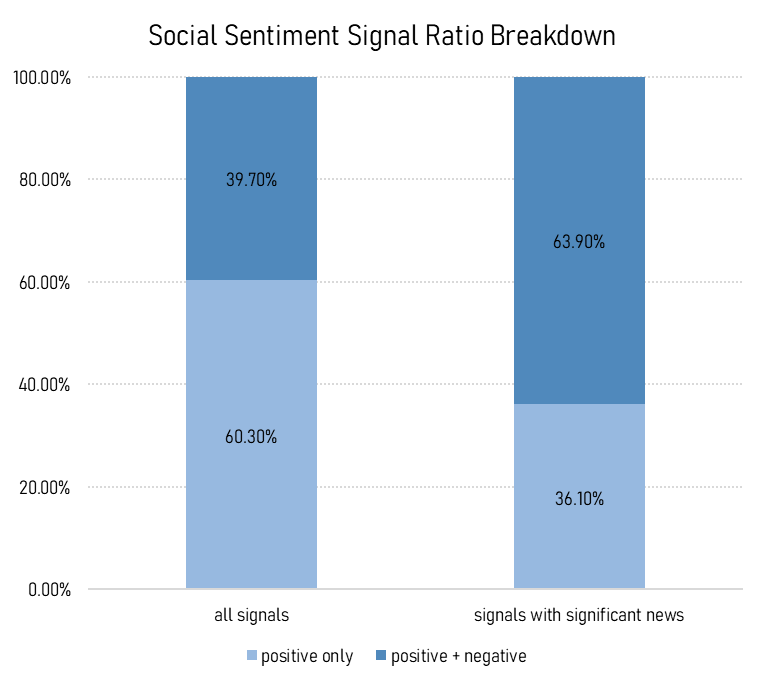

If we filter out trivial news or snobby shills on Twitter, the result is even more appalling: Negative sentiment stalks positive sentiment for the significant, beneficial news (Figure 3).

Figure 2 – A Venn Diagram for Overlapping* Sentiment Signals

*Overlapping : Signal days with both positive and negative signals triggered

Figure 3 – Comparing Overlapping Signals with Significant* News to All Overlapping Signals

*partnerships with notable entities; refer to Appendix for detailed description

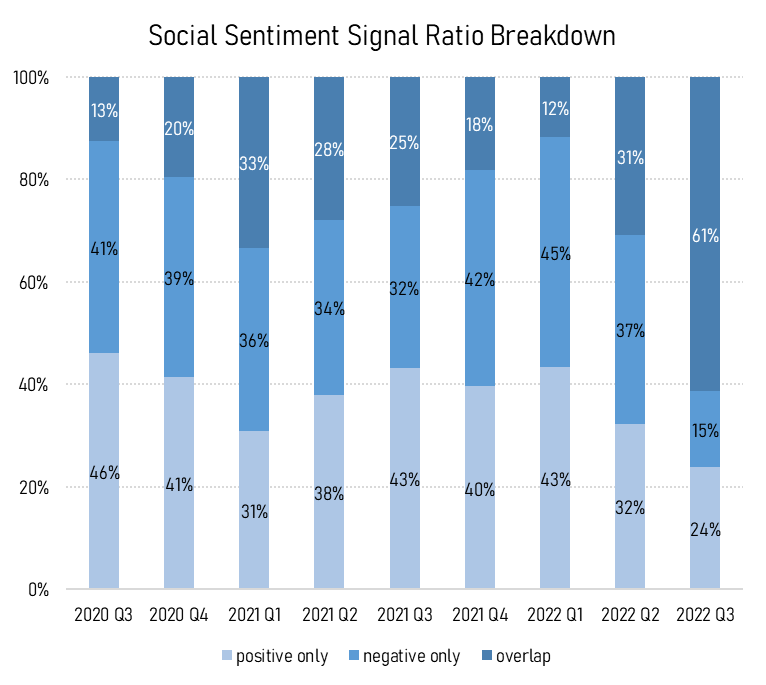

Figure 4 – A Quarterly Time-Series for Overlapping Ratio

3.2. Quality matters

The data saith, “Though thy origins be singular, thine ultimate destiny shall surpass the measure of twentyfold.” (or in modern language, “It is better to aim high and hit one, than to aim low and hit twenty.”)

*partnerships with notable entities; refer to Appendix for detailed description

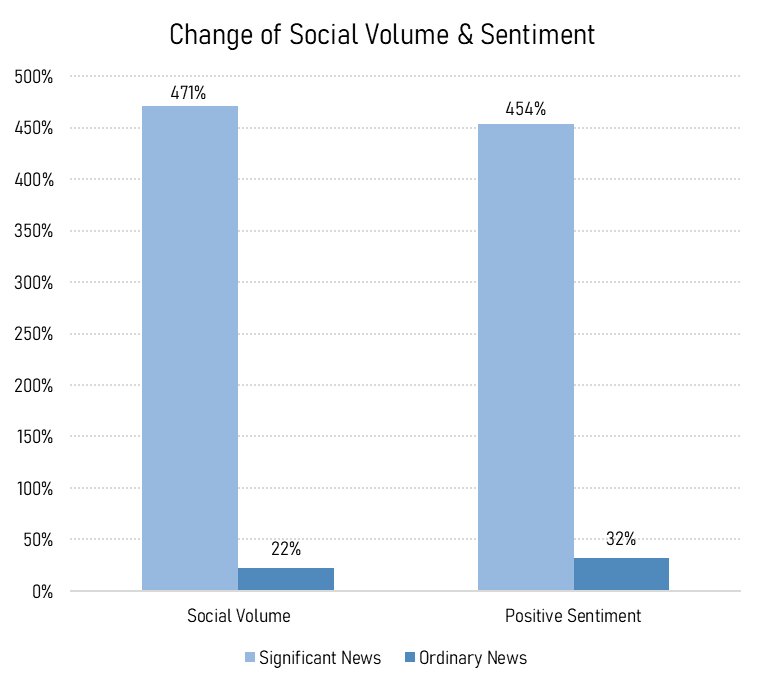

Quality partnerships draw roughly 20 times more attention than ordinary partnerships (Figure 5). In easy words, a Tier 1 CEX* listing announcement generates the same percentage change in buzz as listing announcements in 20 non-Tier 1 exchanges added together.

*Do you want to know which exchanges are classified as Tier 1? Tip : Contact us! (Warning : You might be surprised)

Figure 5 – Changes in Sentiments Under Quality Partnerships

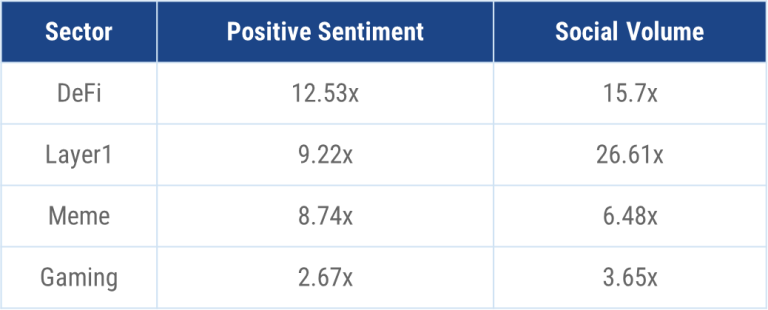

Table 3 – Effective Coefficient* per Sector

*Effective Coefficient = Change under Significant News / Change under Ordinary News

To give a more detailed inspection, sector-wise, L1s are the most sensitive to listings and partnerships, which is coherent to our knowledge that the main business goal of L1s is to expand their ecosystems. Other sectors respond to quality partnerships to a lesser extent, but still do so by tenfold.

Still, Gaming sector seems to be much less enthusiastic about quality partnerships as indicated by the lowest effective coefficient. Focusing on a single quality partnership might not be the best strategy if you are building games. What features of Gaming differentiates it from other sectors? If curious, please read onto the next Commandment.

3.3. A picture is worth a thousand words

The data saith, “Craft unto thyself an effigy, and it shall possess a worth surpassing a myriad of spoken phrases.” (or in modern language, “Visual appeals are your best friend for marketing.”)

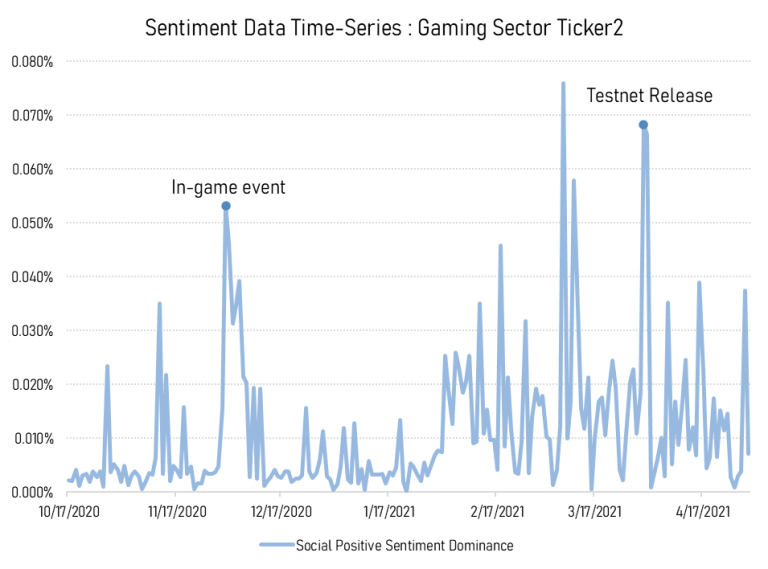

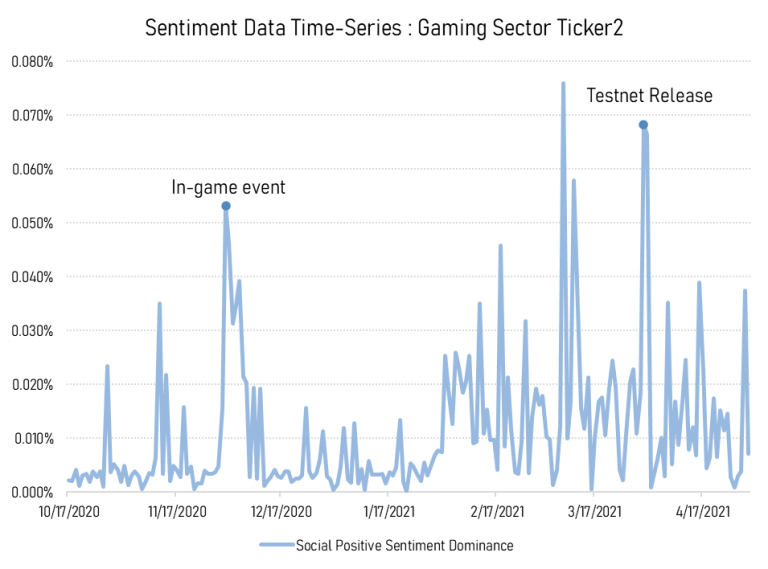

Users, especially gamers, love visible progress. The greatest rises in sentiment dominance of game projects were often paired with visual productions, such as gameplay teasers or playtest builds.

Gamers want to see what they can play in the future. In Web 3, gamers are involved with a Gaming project at an early stage, we should thus attempt to preserve the initial hype by continuously sharing visible progress during the years of development. A simple shill with visual specs could do magic to fill the gap.

We will look at percentage changes in sentiment dominance to study which news categories draw more attention in comparative terms, to verify our assertions.

Figure 6 – Time-Series Plot for Gaming Sector Ticker1 Sentiment Dominance

Figure 7 – Time-Series Plot for Gaming Sector Ticker2 Sentiment Dominance

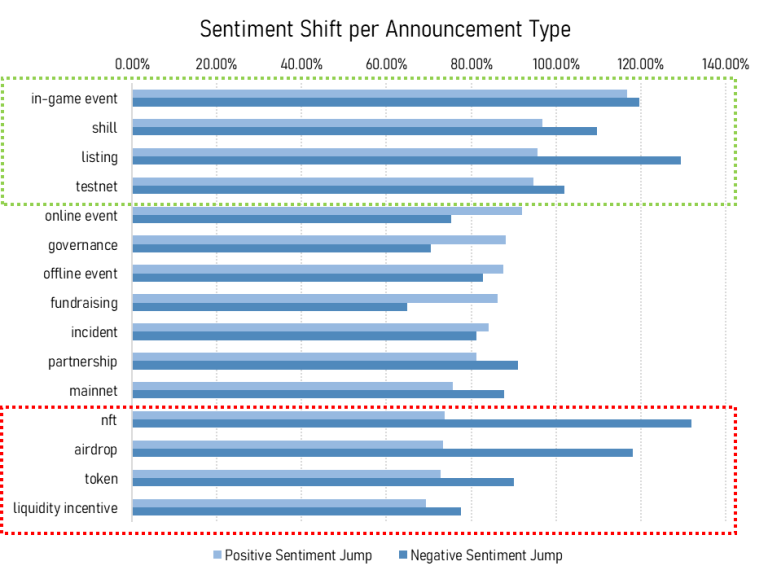

Scanning through the top categories in order of mean percentage changes in dominance (Figure 8), we can easily spot our candidate—listings, as they are pertinent to direct financial benefits. However, we can also see in-game events, shills, and testnets faring quite well on the upper side. The percentage growth of positive sentiment is even greater for in-game events than listing!

To recall our point from Commandment 2, sentiments get boosted the most by significant listing and partnership announcements. Nonetheless, in the Gaming sector, in-game events are comparable to such quality news in terms of percentage sentiment changes.

Figure 8 – Mean Percentage Change in Sentiments per News Category

L1/DeFi projects are conceptual, pragmatic products, thus users are apt to evaluate projects based on usability of their respective functions. For Gaming projects, however, the using experience itself becomes the core product for users. Hence, in-game events or testnet-style leaks appeal to gamers as much as hefty partnerships, and help to maintain the uplifted sentiments.

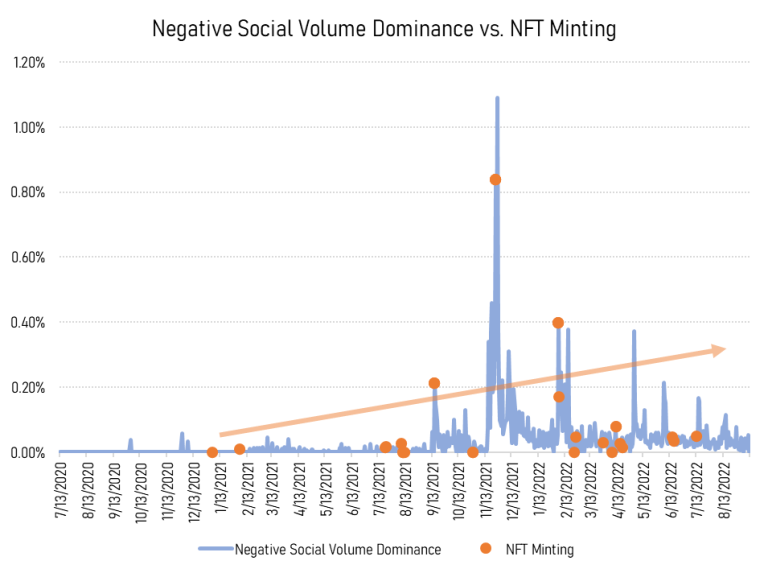

If we look at the bottom of Figure 8, yet one insight stands out: Negative sentiment towards NFT sales. NFTs are ranked 12th in positive sentiment change, but top the list of negative sentiment change. A possible explanation could be that, as NFTs have been increasingly used for viral marketing throughout the last boom cycle, customers were worn out about NFTs flooding the market.

NFTs are a double edged sword; they could stir up a nice response, but much more in a negative way. Thus, we should be careful when deciding on NFT minting strategies, as they may collect a good deal of hashtags, at the expense of possible backlash.

Figure 9 – Negative Social Volume Dominance vs. NFT Minting

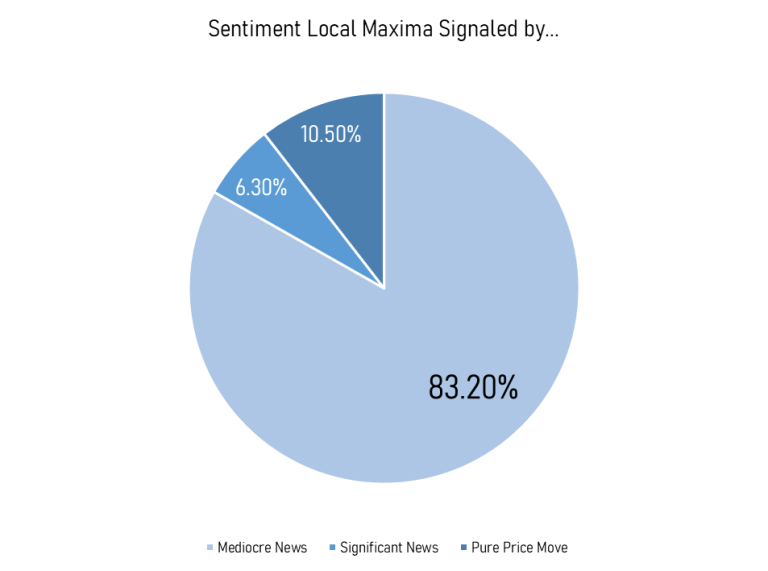

3.4. Chicken first, or egg first

The data saith, “Thou believe not every spirit, but try the spirits whether they are of truth.” (or in modern language, “Distinguish between transitory hype due to price rallies and sentiment improvements due to fundamental growths.”)

*Please refer to Appendix for the definition of sharp rallies/sell-offs

Figure 10 – Proportion of Local Maxima Signaled by Pure Price Moves to Total News Count

*partnerships with non-notable entities; refer to Appendix for detailed description

**for the definition of days with volatile prices, refer to Appendix