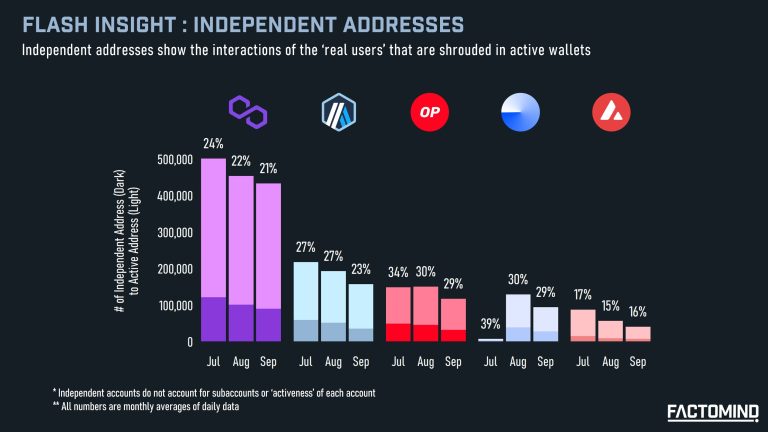

Active Wallets vs Independent Accounts

Important Disclaimer

This content is provided for informational and educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. Furthermore, references to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Factomind cannot be responsible for your use of the information provided in this content. Factomind has established, maintained, and enforced strict internal policies and procedures designed to identify and effectively manage conflicts of interest related to its business activities. Factomind does not own any digital assets mentioned below, nor has it made any purchases or sales of the digital assets mentioned below. All materials in this research paper are sourced from publicly available information.

When we use active wallet counts to gauge the fundamental scale of a blockchain, are we getting the whole story? Are we acknowledging that 1M+ active wallets on the top 5 EVM chains may not all be that ‘active’?

Dapps, not the end users, also often utilize wallets to provide the services, and while these wallets do constitute valuable information, they are secondary information in studying the actual demands of the blockchains.

- Arbitrum’s 0xe93685f3bBA03016F02bD1828BaDD6195988D950 address is a non-contract, EOA address; yet the address does nothing but calling LayerZero’s Relayer contract.

- Base’s 0x1985ea6e9c68e1c272d8209f3b478ac2fdb25c87 address is also an EOA address that never calls a contract, but behaves essentially like a contract as it is a Base bridge address.

If a chain is congested with 900,000 wallets updating oracles, and 5 wallets using the actual services, the chain might be a bit far away from the mass adoption.

We introduce the concept of independent addresses to tackle the defect to gauge the activities of actual demands. By using independent addresses, we can

- 1) Identify the actual demands compared to active wallets and

- 2) Check whether a blockchain’s activity is from actual demands or from spammy contracts

- OG Chains, such as Polygon and Avalanche, have relatively lower independent addresses compared to their active wallet counts. (i.e. They have relevantly high activities of smart contracts compared to user activities.)

- Arbitrum seemed to be in a huge lead in L2 wars in terms of active wallets, but is in a similar stage to Optimism and Base when looked through independent addresses. (i.e. Most of the Arbitrum’s lead in metrics came from smart contracts, not end users.)

To distinguish independent addresses, we applied the following logics:

- 1) Contract-calling accounts : EOA accounts that sends more than 24 transactions/day (hourly calls), interacted with less than 5 contract addresses during their histories, and of which >99.9% of the transactions are contract calls.

OR

EOA accounts that interacted with only a single contract address. - 2) Bridging accounts : EOA accounts that sends more than 100 transactions/day, have 0 contract calls, and sends to more than 100 unique addresses per a day.

- 3) CEX accounts : We used public labels to identify CEX accounts.

- *Note that the ‘transactions’ for calculating independent accounts only include zero-value transactions.