Friend.tech Trend.check - Part 1 of 2

Table of Contents

Part 1

Part 2

Important Disclaimer

1. Introduction

A core value proposition of the blockchain technology was the perfect and public traceability of transactions coupled with pseudo-anonymity. However, as the technology matured and gradually came under regulatory oversight, the focus shifted from anonymity to traceability for institutions.

Considering blockchains as consumer products (or at least middlewares for hosting such applications), we needed a way to bridge the discontinuity between on-chain personas and real-world identities for consumers; this was essential to study their behavior, preferences, and inclinations. Fortunately, the advent of Friend.tech provided a smart solution by tying a Twitter account to an on-chain wallet, enabling us to connect the dots.

The blending of two isolated worlds–Twitter, a public forum for exchange of ideas, and a blockchain, an anonymous layer for exchange of assets–proposes a new perspective for studying consumer behavior. Do consumers try out the new Alt-L1 projects they are following? Does “farming engagements” on Twitter help with user acquisition on blockchains?

Harnessing the power of blockchain traceability and the Twitter networks, we are finally able to prescribe answers to those once-unanswered questions.

Moreover, leveraging the comprehensive dataset at our disposal, we crafted a diverse set of business strategies encompassing areas such as marketing, GTM optimization, product management, and more. To discuss the topic further, please reach out to us separately via email.

Executive Summary

- 1. Data show that Twitter activities are significantly related to on-chain activities

- a. Growing a project’s presence on Twitter typically prompts a larger user base for the product

- b. In that sense, farming engagements on Twitter is worthwhile as it grows Twitter presence, which leads to more transactions

- 2. Incorporating Twitter into onboarding quests is also beneficial for defending against sybil attacks (a.k.a. Botting activities)

- a. Fully on-chain criteria, such as Arbitrum, had 60% of the participants suspected to be sybil attackers,

- b. Whereas for Friend.tech, only 20% are suspected to be sybil attackers

- 3. Projects using NFTs should prioritize growth on Twitter even more

2. The Connectedness of Social Media and Blockchain Activities

Data Specification

We gathered 335,987 Friend.tech addresses from the public API as of block height 5,270,000 on the Base blockchain, roughly equivalent to the real world timestamp of 15 Oct 2023. The Friend.tech API provides information on the linked Twitter profile for each Base address.

Via the public Friend.tech API, we obtained an externally owned account (EOA) address on Base for the Friend.tech application, along with the username of the Twitter account that is linked to the EOA address.

We used specific filtering mechanisms to identify the ‘ultimate funders’ of Friend.tech addresses, and applied our analysis on these wallets.

We left out the details for being tedious and long. For detailed methodologies, please contact us.

Section Summary

We often observe projects (or even influencers) participating in ‘farming engagements’ on Twitter timelines, incurring tangible expenses in the form of tokens. However, debates on the effectiveness of such marketing costs are always two-sided as there are always projects that have succeeded without resorting to such measures; moreover, we never know whether the successful projects that have successfully farmed engagements would have failed or not without the promotional actions.

Based on the data we have collected, we are confident that the activity on Twitter is closely linked to the on-chain activity. Therefore, ‘engagement farms’ are effective in bootstrapping consumers for token-based projects (note that we are not studying cost-effectiveness).

By coupling our prior knowledge of SNS marketing with its impact on blockchain activities, we can formulate powerful business strategies optimized for business goals.

2.1. All Tweets Lead To Rome

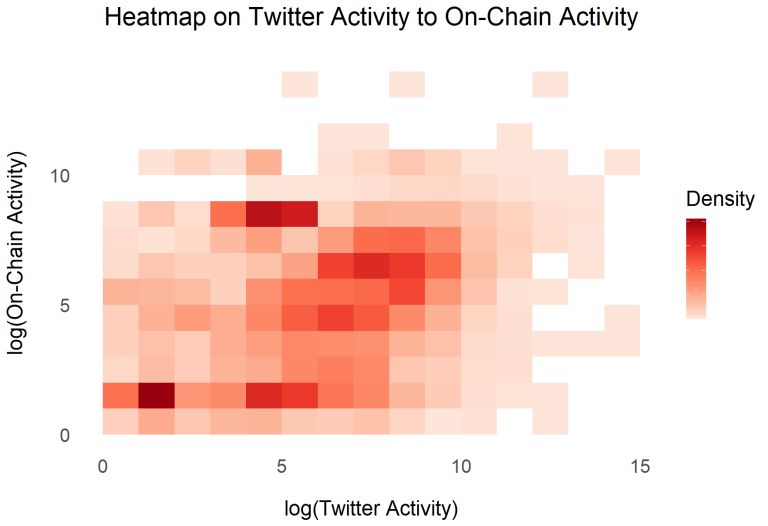

Twitter activities serve as indicators to on-chain activities. To incorporate small accounts actively participating in crypto-related conversations, we define ‘Twitter activity’ and ‘on-chain activity’ as follows:

- – Twitter activity : Followers Count + Friends Count + Statuses Count

- – On-chain activity : Sum of Transaction Count across 5 blockchains

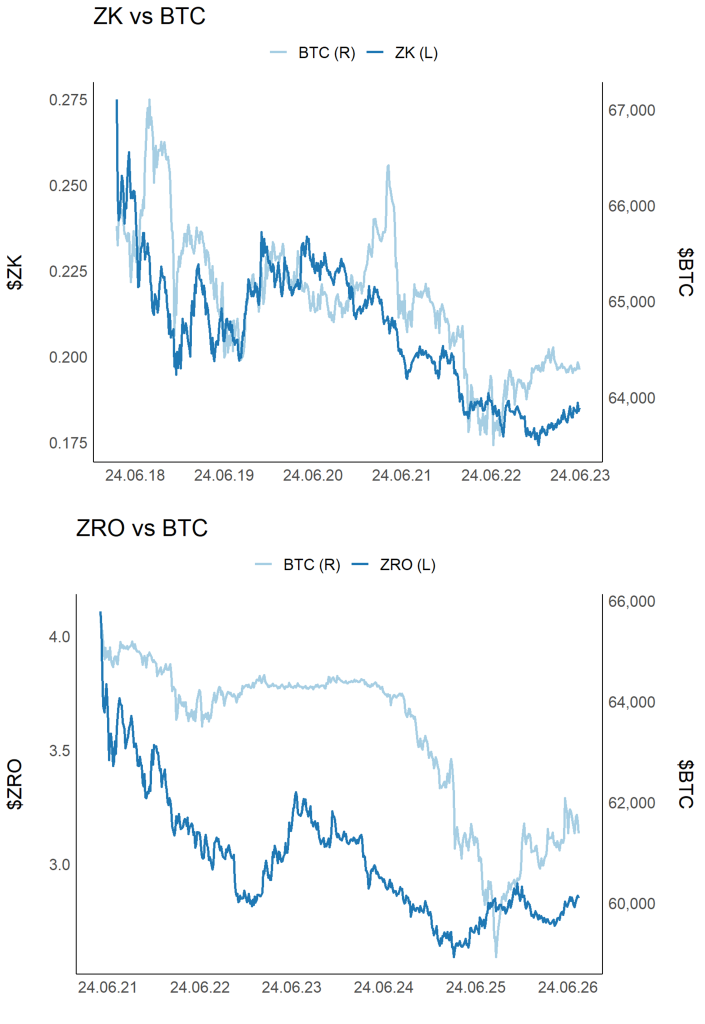

By mapping Twitter activity to On-chain activity on a Cartesian coordinate plane, we discovered a significant positive relationship between the two variables, as visible in Figure 1.

Figure 1 – Heatmap on Twitter Activity to On-chain Activity

2.2. Judge A Book By Its Cover

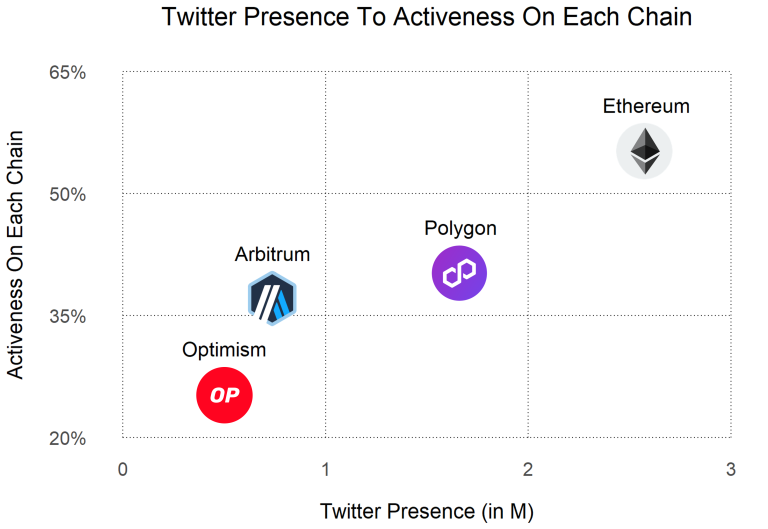

We have established that the consumers – the holders of the Friend.tech addresses – are more likely to try out Web3 products if they are active on Twitter. Next we move to the supplier side to investigate if the suppliers’ presence on Twitter helps users to use their products more.

To verify the claim, we will examine each projects’ presence on Twitter, denoted by their followership, and map the numbers against the activeness of Friend.tech users. The logic is that ‘the higher their presence on Twitter, the higher the activeness of Friend.tech users.’ This piece of information could serve as supplementary evidence support to our initial claim.

We define our metrics as follows:

- – Twitter Presence : Twitter Followers Count

- – Activeness : (# of Friend.tech accounts that have made ≥1 transaction or that have ≥0 balance of native token on each chain)/(Total number of Friend.tech accounts)

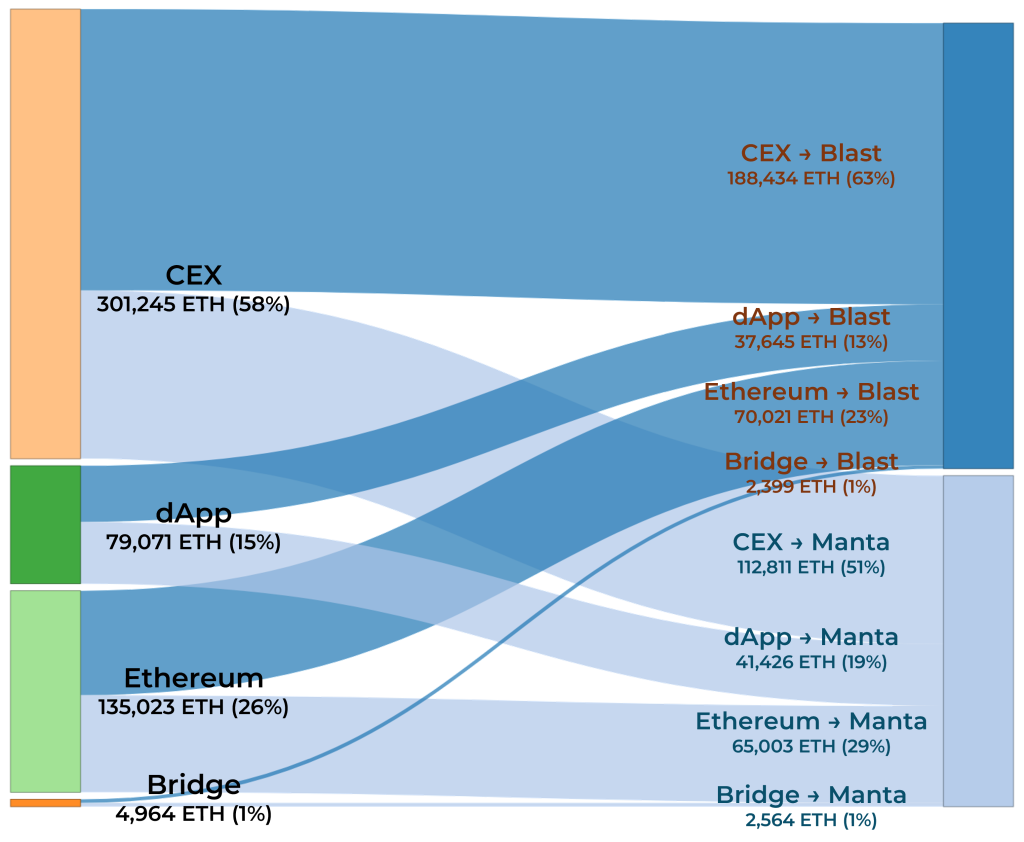

Figure 2 – Comparison of Twitter Presence to Activeness on Each Chain

*Base excluded – read on for details

In Figure 2, we can visually inspect the positive relationship between Activeness on each chain (or participation rate) and the respective Twitter presence of each chain. The data availability layer stands out as it essentially is a base layer that supports native bridging to all Layer 2s; Polygon, Arbitrum, and Optimism follows in that order.

In simpler terms, among the ultimate funders of the sampled Friend.tech accounts, 58% have sent at least 1 transaction on Ethereum, 43% on Polygon, 40% on Arbitrum, and 28% on Optimism.

The Base Chain was excluded in Figure 2 because Friend.tech is a Base project. Therefore, it is highly likely for users to move funds from their Base accounts if they have already stored some ETH there; moreover, our logic identifies those Base accounts as the final funding wallets if they have transacted more than 5 times, which is a fairly low hurdle.

Please note that our definition of ‘Activeness’ only requires these accounts to ‘try out’ the chains. It does not consider whether these wallets are actively participating or not as the filtering logic requires only a single transaction.

Nevertheless, the sole purpose of Galxe quests and Twitter engagement farming is to entice Twitter users to explore the newly launched blockchain project, and we believe that the purpose is fulfilled.

2.3. Build For A Great Multitude

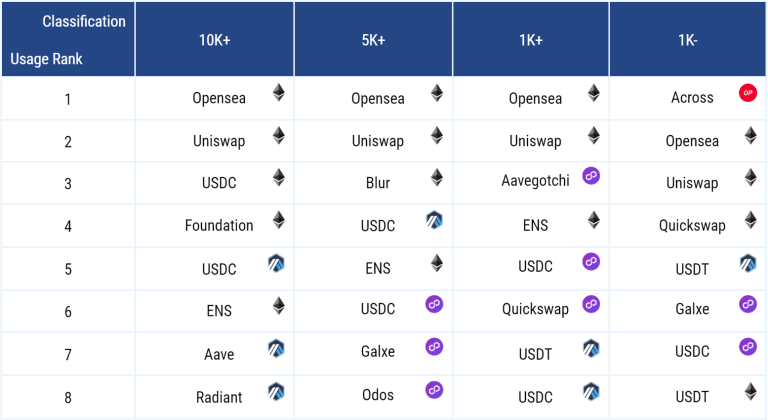

To take a deeper look at the behavior of Friend.tech account owners, we studied the full history of contract interactions of the identified funding accounts.

Table 2 is tabulated based on the sums of the transactions to avoid massive transactions from a few accounts significantly affecting the ranks.

Most interactions were dominated by Ethereum Opensea and Ethereum Uniswap; however, the dominance is natural, considering that Layer 2s are relatively new compared to the Ethereum blockchain.

Table 1 – Contract Usage Rank Per Subgroup

*Contracts that are interacted by less than 2 wallets are dismissed (e.g. Cyberkongz on Polygon)

Galxe quests pop up in 5K+ accounts and 1K- accounts as the most interacted contracts, so we are confident in asserting that engagement farming on Twitter does influence Twitter users to transact with on-chain quests. Given that the majority of Twitter population falls into the 1K- subgroup, the fact that these users are fervently interacting with on-chain quests underscores the effectiveness of engagement farms.

2.4. Expense Is Bitter, But Its Fruit Is Sweet

*Twitter distinguishes Followings as ‘Friends’ in its back-end, whereas the front-end displays ‘Followings.’

Figure 3 – Projects Followed By Most Friend.tech Accounts (On Twitter)

* % Followings are calculated by (number of Friend.tech accounts that follows a certain account)/(total number of Friend.tech accounts excluding deleted or suspended accounts)

** We classified Farms as TRUE if projects have run quests to encourage interactions on Twitter (ex. friendtech, Blast_L2) or have simply executed quests of some sorts (LineaBuild, PolyhedraZK)

Out of the top 18 accounts ranked by the number of followings in our Twitter dataset of Friend.tech accounts, only 2 users have not engaged in ‘engagement farming.’ These users are @elonmusk (Elon Musk) and @IntractCampaign, a questing platform similar to Galxe, thus it is still linked to engagement farming actions.

Remaining projects have thoroughly run engagement farming quests, which range from simply Retweeting some posts to earning points based on interaction with posts with cashtags.

Other projects that have run quests – Venom, ZetaChain, etc. – also narrowly missed the spots.

While not all projects in Figure 3 have succeeded in conventional terms, yet we do witness a handful of hyped and not-yet-launched (or very recently launched) projects as well.

In summary, conducting airdrop quests or incentivized testnets does help in generating hype around products for consumers who are deeply involved in the Web3 industry (that they use Friend.tech).

3. Do Bots Dream Of Airdrops?

A very frequent criticism regarding the airdrops is the extreme botting behavior to maximize the airdrop return, which is also known as ‘sybil attacks.’

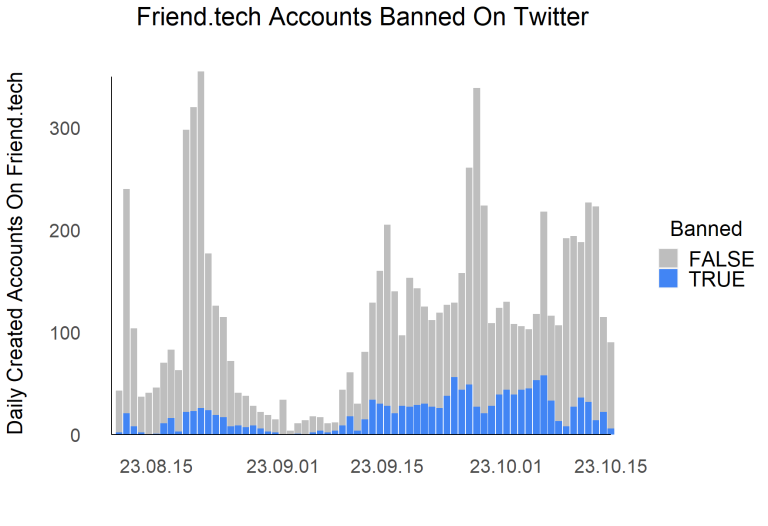

Unluckily, the Friend.tech dApp did not escape the fate either. Although we cannot accurately gauge the true size of bots involved in Friend.tech, we do have Twitter policies that ban suspicious accounts.

As of Nov, roughly 20% of all created Friend.tech accounts are either Suspended or Deleted on Twitter for exhibiting suspicious behavior.

Figure 4 – Newly Created Friend.tech Accounts That Are Banned On Twitter

The number of banned accounts drastically increased in the later stages of the sample timeline, coinciding with the second spike in user inflow to Friend.tech.

The Friend.tech point mechanism requires spreading out referral links and to be frequently watchlisted to earn the most points, especially if the user does not wish to spend material budgets to inflate the trading volume. This feature makes it susceptible to becoming a target of sybil attacks.

However, even though we cannot take it for granted that Twitter succeeds in banning every single bot account, sybil attacks on Twitter should fundamentally be more challenging than on-chain sybil attacks. In fact, the 20% Suspended (= 20% sybil) is much lower than the Arbitrum’s estimated 60%.

It might not be a bad idea to incorporate some Twitter aspects when designing on-chain quests to alleviate botting behavior.