A Post-Mortem on Money Printer Go $BLURRR - Part 2 of 2

Table of Contents

Part 1

Part 2

Important Disclaimer

4. You Got Me Looking for Retention

It has been 1 month since the $BLUR airdrop, and we believe now is the time to look back on the consequences of the airdrop. What were the primary responses of the airdrop recipients? Did any new guys join Blur after the airdrop? Was it a successful marketing campaign?

First, we will examine the actions of the recipients.

4.1. The First Actions

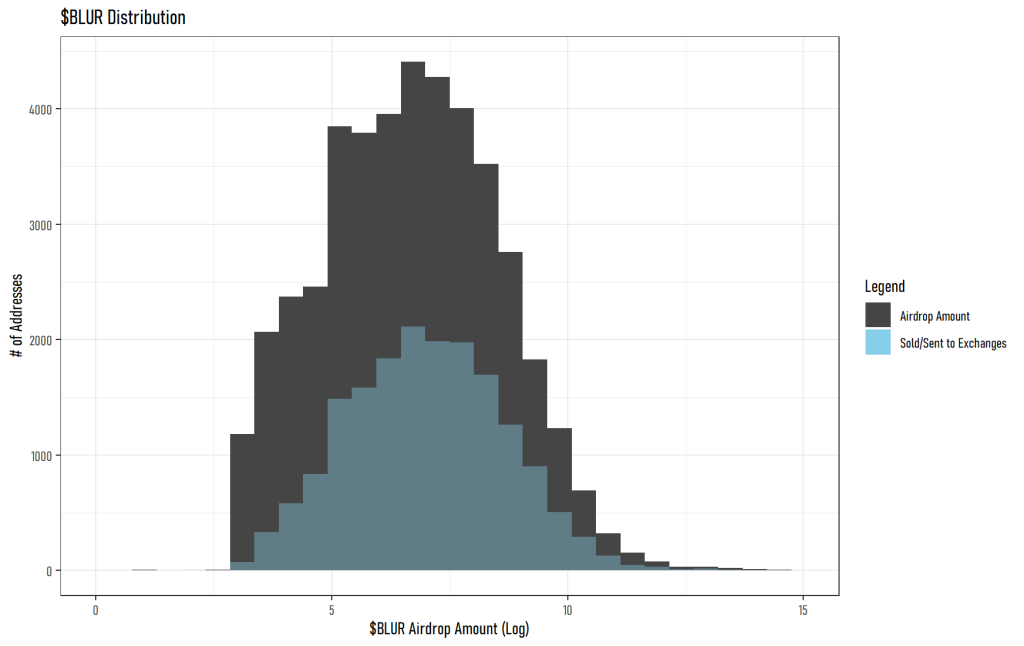

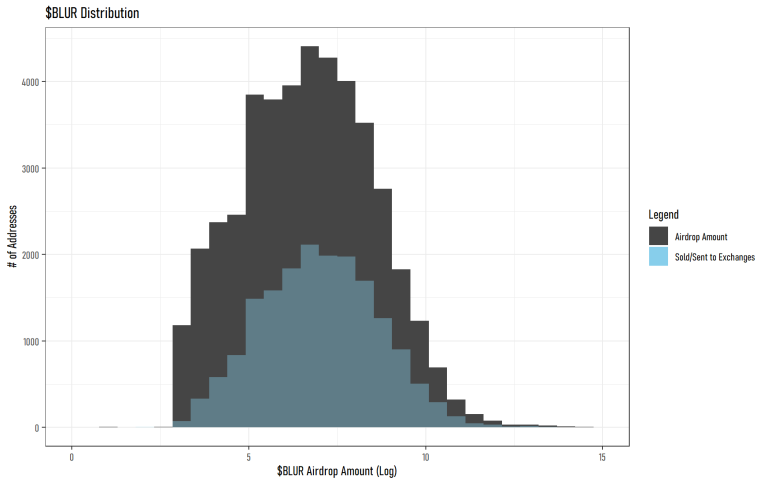

Figure 6 – The Behavior of the $BLUR Recipients

Roughly 40% of the airdrop recipients sold or moved $BLUR to exchanges right away, and people who received an adequate amount (meaning not too small or too large) were more likely to sell.

One intriguing observation is that people preferred to use DEXes to sell their $BLUR, as 82% of the recipients placed their orders on DEXes (ex. Uniswap) rather than CEXes (ex. OKX). The largest selling volume of DEXes were on Uniswap at 50M $BLUR, and it was five times of the largest selling volume of CEXes on OKX at 10M $BLUR.

4.2. A Post-Mortem on $BLUR Airdrop

We will evaluate the performance of the $BLUR airdrop in three aspects: User retention, user acquisition, and integrity of trading volume.

Let us address the last one first.

Integrity of Trading Volume

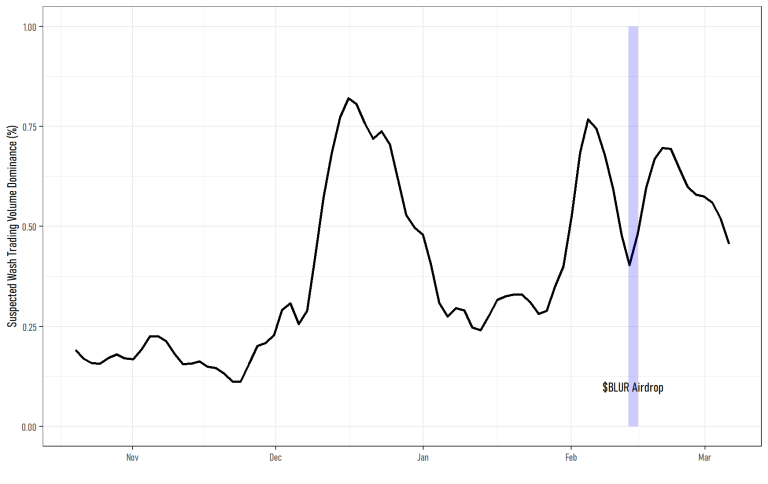

Figure 7 – Time Series of NFT Blue Chip Suspected Wash Trading Volume on Blur

The suspected wash trading volume on Blur rose as the day of the airdrop approached, and even after the airdrop 50%+ of the Blue Chip trading volume on Blur is suspected to be wash trades for farming future $BLUR rewards.

As for the traders, there have been many accusations and verifications of a few whales dominating most of the trading volume on Blur, and we verified the claim once again. We found out that top 100 wallets account for 44% of the total trading volume after the $BLUR airdrop. Percent-wise, the number would translate into 0.2% of players dominating 44% of the trading volume.

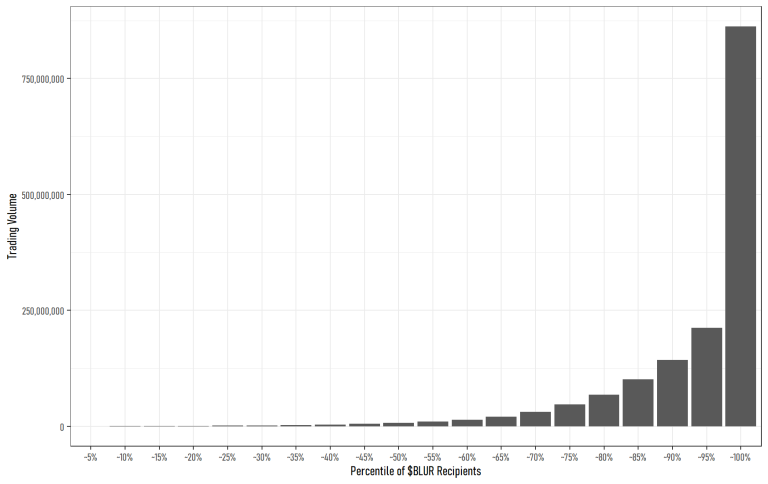

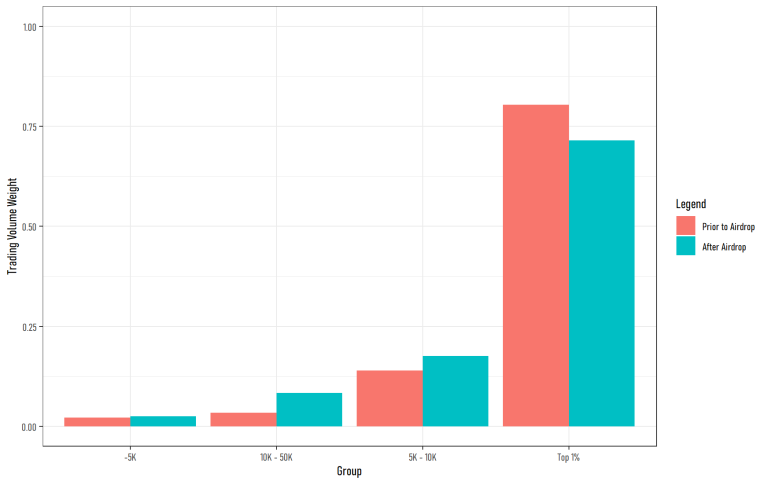

Figure 8 illustrates the percentiles of the recipients and the respective trading volume after the airdrop.

Figure 8 – Trading Volume by Percentile After the $BLUR Airdrop

Figure 9 – Whale Trading Volume Dominance Prior vs After Airdrop

Is Blur being dominated by a few whales after the airdrop? Yes.

But Blur was being dominated by a few whales even before the airdrop.

The phenomenon is again very anticipated as Blur itself clarified in its mission statement that it was building a product for pro NFT traders to trade more fluidly and flawlessly. In other words, Blur was meant to be used by those who trade NFTs a lot.

User Retention & User Acquisition

This section will answer the question: “Do the airdrop recipients return to the protocol?”

We scraped the entire trading history on Blur after the airdrop, filtered for all the involved addresses, and compared it to the list of airdrop recipients.

After one month from the airdrop, among 43K airdrop recipients, 15K bought at least an NFT

during the last month, and 18K sold at least an NFT during the last month.

Moreover, there has been an influx of 48K new NFT buyers and 78K new NFT sellers since the airdrop.

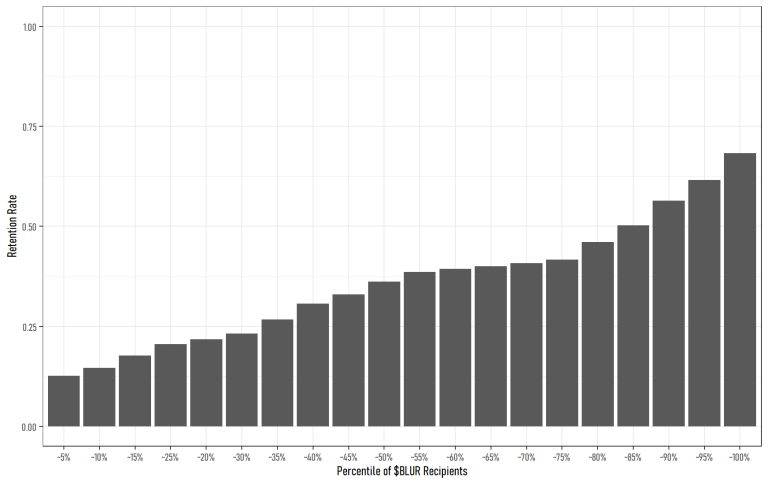

Figure 10 – Retention Rate to Airdrop Amount

We can also check that retention rate strictly increases with the airdropped amount.

Overall, the retention rate falls within 20% ~ 25% range in terms of sheer wallet count, and the airdrop was a quite effective marketing strategy as it drove in more users than the airdrop recipients.

If we were to nitpick, however, the ratio of the retained wallets to the newcomers is 24:76, but the trading volume ratio of the retained to the newcomers is 61:39. This suggests that most of the trading volume is still coming from the retained wallets.

5. Key Takeaways

Overall, the $BLUR airdrop was a success as it was effective in driving both user retention and acquisition. The lootboxes for Blur usage (Airdrop 2), rather than the initial airdrop (Airdrop 1) comprised the majority of the airdrops.

Traders who mainly traded Blue Chips, traded 200+ times with an average size of $500 per trade were more likely to win 10K+ $BLUR, and these traders have spent $3K in fees on average, making their net gains around $5K+ range. Trading Blue Chips proved to be more effective than trading minor collections despite their high royalty fees. However, suspected wash trades also occupied the majority of the Blue Chip trading activities.

Maintaining bids for some time and canceling is also a viable option as all airdrop recipients had 10%+ order cancellation rate.

The retention rate for airdrop recipients increased with the airdropped amount, and the airdrop attracted more users than the airdrop recipients after the drop.

Looking at the post-mortem, the $BLUR airdrop was pretty successful as a marketing campaign.

(End of this paper)