A Scribble On Sybil Accounts

Table of Contents

Index

Important Disclaimer

1. Introduction

The recent debate on social media about filtering sybil accounts has raised a critical question in the minds of founders: Is filtering sybil accounts necessary when designing airdrops?

Two new projects, $ZK and $ZRO, have thoroughly scrutinized the recipients to screen for sybil accounts, or multiple wallets owned by a single entity that fabricates engagements with the projects to profit from airdrops. As a result, both projects faced harsh backlash on social media. Their objectives were clear: Both projects clarified that they planned to grant governance rights to the ‘legitimate’ people, or actual individuals who have been organically involved with the projects.

From this point forward, we would like to address a critical question: “Is the sybil filter beneficial or detrimental for the projects?”

We have established three hypotheses to describe the aftereffects of applying the anti-sybil filter, under the premise that the key indicator for the projects’ success is the token price.

– The sybil filter is beneficial for the project: Organic users are rewarded with more benefits as sybil accounts are filtered out from the airdrop eligibility. Thus, organic users are encouraged to interact even more with the protocol, enhancing the project’s fundamentals. Moreover, sybil accounts may have a higher intention of selling, as they are less likely to be interested in governance given that their purpose was to profit from the airdrop. Overall, these two characteristics may lead to a higher token price compared to not filtering.

– The sybil filter is detrimental for the project: Sybil accounts are more likely to be deeply involved within the Web3 industry, and thus are more likely to be active and vocal within communities. Filtering these accounts out may prompt them to spread negative sentiments across the community, leading to a lower token price.

The exact method of analysis will be shared below.

– The sybil filter is neutral for the project : Filtering sybils has no impact on the token price.

This paper is the third in our airdrop series; previously, we have written about KPIs to consider when designing airdrops, and about whether point-based airdrops are overall beneficial or detrimental to ecosystems.

Executive Summary

- Filtering for sybil accounts does not impact a project’s token price, at least in the short term

- However, filtering could induce bad sentiments to grow, but it still does not affect the token price

2. Data Specification

As our goal is to measure the impact of sybil filters, we first need to estimate the magnitude of sybil attacks on each airdropped project – in other words, answer the following question: “How many sybil accounts were included in the airdrops?”

Sybil Filters

Sybil accounts, by definition, are multiple wallets owned by a single entity that engages in protocols to profit from receiving airdrops, and are considered to be parasitic to the projects.

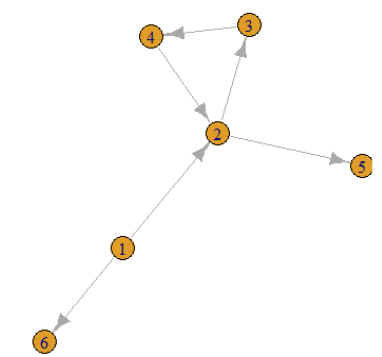

The best way to identify the sybil accounts is to build a networked graph of fund flows and look for loops in these flows, as we have done to detect NFT wash trading activities.

Figure 1 – An Example of a Directed Graph with a Loop

Nonetheless, the problem with network graphs is that we have to know every transaction occurring on-chain. Not all airdropping projects use public blockchains, and even if they do, some are not supported by data providers.

Therefore, we resorted to a second-best method that is less accurate, but is equally applicable to all projects in the sample.

Criterion 1

Sybil ratio = Eligible Wallets ÷ Candidate Wallets

*Eligible wallets : If the eligibility list is provided by the foundation, all wallets in the list are included. If not, all airdrop claimants are included. As empirically >90% of airdrops are claimed within 24 hours of the opening, we believe that the discrepancy in numbers is minimal.

*Candidate wallets : All wallets that have interacted with the projects are included here. For example, traders with volume > $0 for DEXes, users with transaction > 0 for public blockchains, or deposits > $0 for private blockchains.

By defining the sybil ratio, we aim to capture the magnitude of “how heavily have the projects filtered out the sybil accounts.” Intuitively, the fewer eligible wallets there are out of the candidate wallets, the more robust the sybil filtering mechanism would be.

To have a closer look at the comparable public blockchains, we introduced the following criteria to identify sybils

Criterion 2 (Supplementary)

– EOAs that have recorded more than 5 transactions with the same non-contractual EOAs, regardless of directions of funds

– EOAs that have transacted with non-contractual EOAs at least twice as much as with contractual EOAs

The first condition is a crude sieve to identify circular movements within wallets, and the second condition indicates if an account does not use dApps.

Note that the above two criteria are applied differently: We use the initial criteria for the overall analysis and apply the supplementary criteria only if we decide to make a closer comparison between peers.

Research Methodology

Upon filtering the sybils, we aim to measure the impact of these filters on the projects. We analyzed the projects from three perspectives to gauge the impact of sybil filters.

- Perspective 1: Post-listing price movements over a week compared to BTC and ETH

- Perspective 2: Social media sentiment analysis of the airdrop announcements

- Perspective 3: On-chain activity comparison for public blockchains (Only for Criterion 2)

Perspective 1 is primary, while perspective 2 and 3 are supplementary, as our primary focus is to study impact on token price.

For perspective 1 and 3, the methods are self-explanatory. For perspective 2, we employed a dictionary-based sentiment analysis to quickly assess social factors for simplicity. A dictionary-based method is a basic form of text mining that assigns sentimental scores to each vocabulary and aggregates these scores to derive an overall sentiment distribution.

We have selected samples that:

- i) have executed a significant amount of airdrops,

- ii) are supported by major data providers, and

- iii) are listed on Binance.

The first two conditions are self-explanatory, and the third condition is included to mitigate impacts arising from the listing itself.

3. Result

First of all, we assign the ‘sybil ratio’ to each sample project based on the aforementioned criteria. The results are as follows

Please note that the ‘sybil ratio’ here merely measures stringency of terms for airdrops and does not imply that the percentages indicated actually represent sybil accounts.

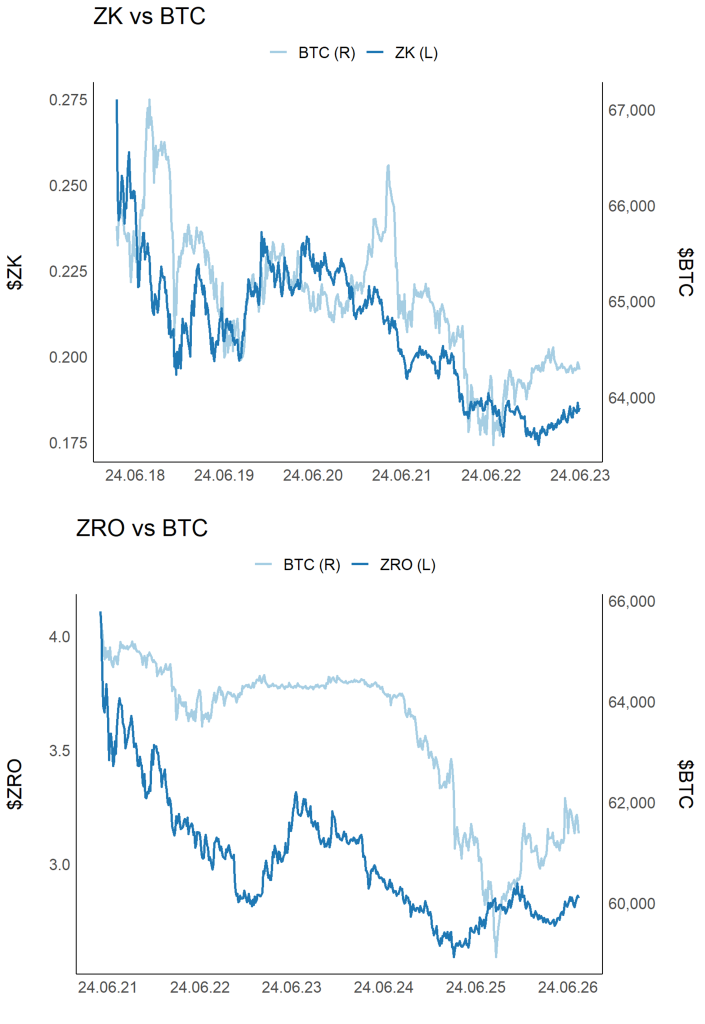

Table 1 – Sybil Ratio for Sample Projects

The high sybil ratio for $OP is understandable as $OP has drawn public attention towards airdrop farming behavior, and thus it may not have considered such behavior critically.

On the other hand, $ZK and $ZRO, the two projects that have actively targeted sybils, appear at the bottom of the table, reinforcing the credibility of our sybil ratio definition.

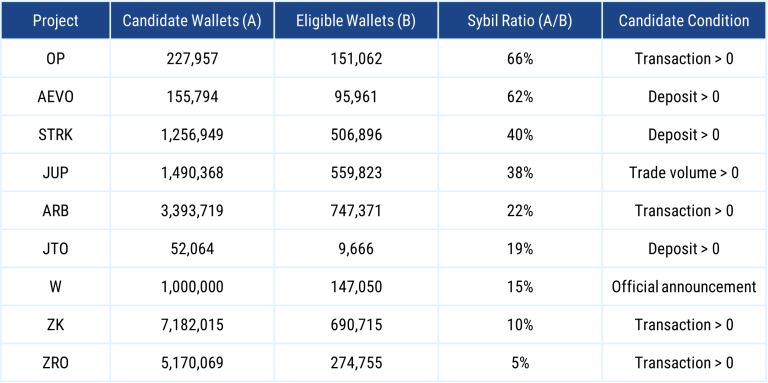

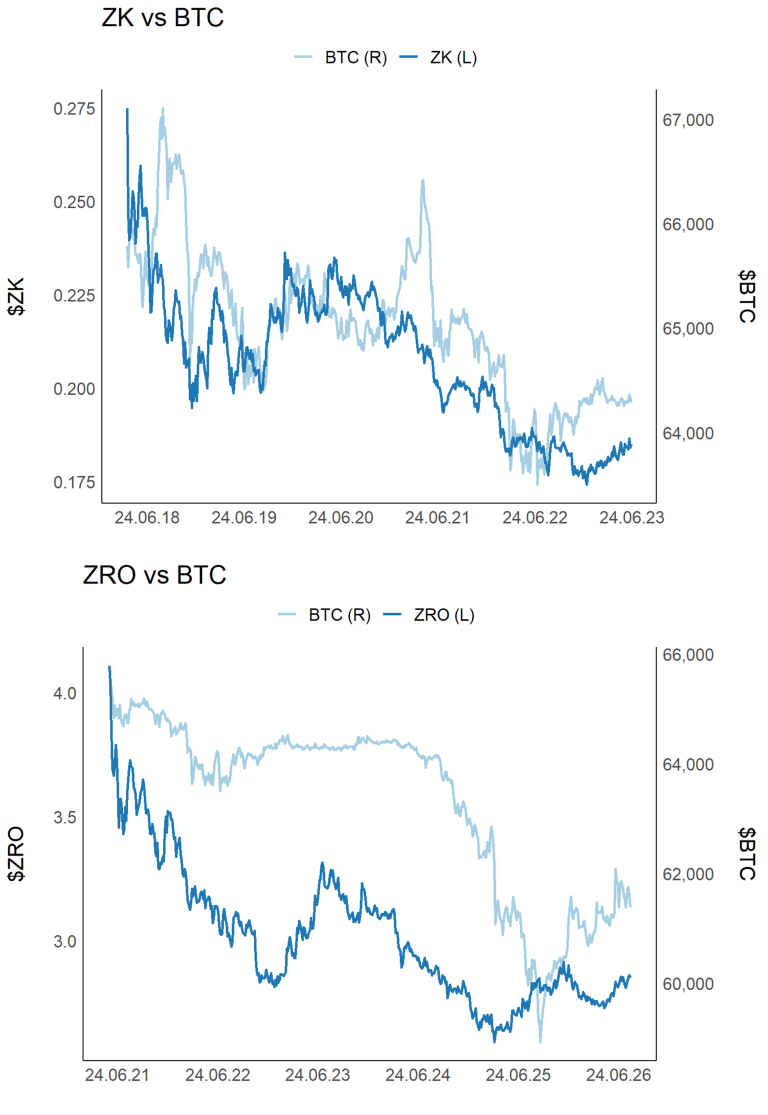

With the sybil ratio in mind, we analyze the post-listing price movements of the sample projects compared to BTC and ETH, examining whether a high (or low) sybil ratio influences these movements.

Figure 2 – Sample Price Movements of Sample Projects vs BTC

Since visual inspection of 9 projects did not yield satisfactory results, we turned to numerical analysis.

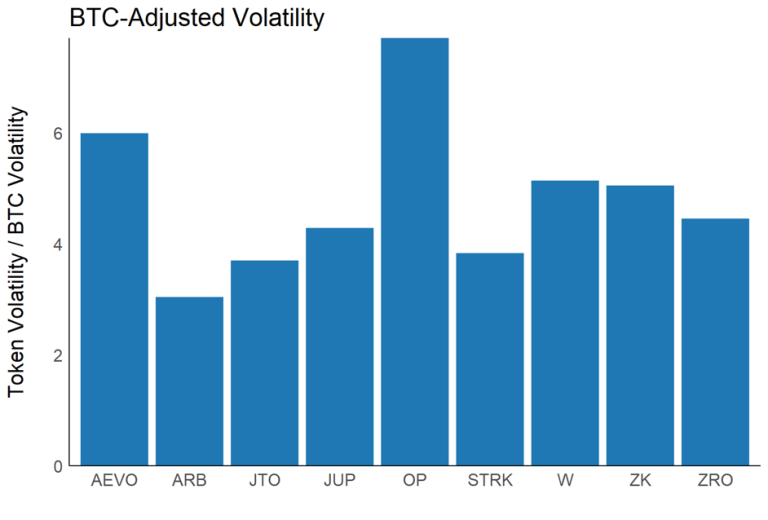

Figure 3 – BTC-adjusted 15-min Return Volatility

The token returns of all projects, irrespective of their sybil ratio, show a high correlation with BTC and ETH returns (p < 0.01), as do other statistics.

Hence, we might conclude that filtering for sybil accounts neither positively or negatively impacts the post-listing token prices of projects.

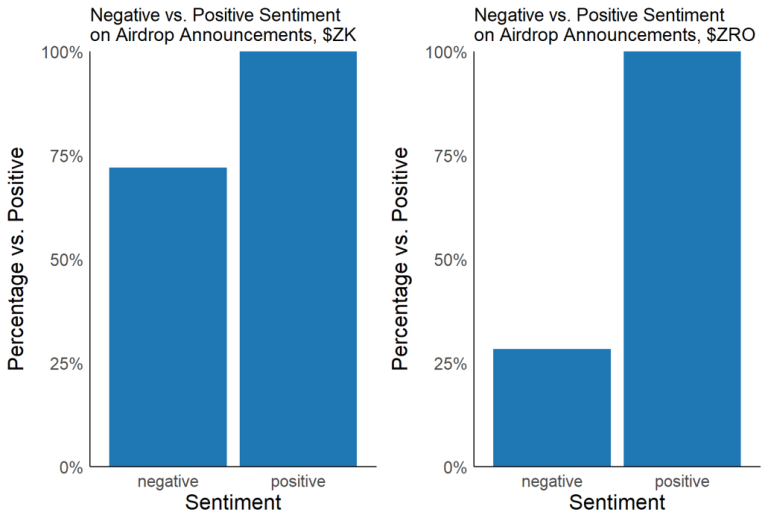

For social sentiments, we analyzed the top tweeted posts on the day of the airdrop announcement, using a sample size of approximately 300, to briefly assess sentiment.

Figure 4 – Sentiment Analysis for $ZK and $ZRO

For most of airdrops, including $ZRO, a heavily sybil-filtered project, the distribution of sentiments is very similar. However, for $ZK, the negative sentiment skyrocketed due to the spamming of the hashtag ‘#zkscam.’

Although $ZRO also stirred up some clamor regarding the SEC on social media, the reason for the uniquely high negative sentiment on the $ZK airdrop might be that $ZRO provided a sufficient time window for appeals, whereas $ZK did not.

Nonetheless, such sentiment has a negligible effect on the project’s price performance in the short term.

It should be noted that the methodology applied above (dictionary-based) is too basic to render any in-depth analytical results.

Lastly, we briefly checked the on-chain behaviors of accounts identified as sybils and those that are not, based on the second criterion among $ARB, $OP, and $ZK.

The results show that the selling intentions of airdrop recipients do not differ by sybil characteristics – whether they are sybil or not, 90% to 95% of accounts immediately sell their airdrops (at least partially).

Regarding retention, airdrop receivers have a slightly higher retention rate compared to the non-receivers (70% to 40% for Arbitrum, and 40% to 15% for zkSync), yet the causation is unclear. Airdrops could have ‘caused’ these accounts to stay on the chain, or the accounts with higher retention rates could have just received the airdrops.

As in-depth on-chain analysis of the effect of airdrops is beyond the scope of this study, we will stop here.

4. Concluding Remarks

Filtering for sybil accounts require tremendous manpower, and as a result it grants:

– no impact on the token prices

– (possibly) bad sentiments

In other words, filtering for sybil accounts neither benefits nor harms the project’s token price (in the short term). As heavy filtering has only become more common recently, if $ZK and $ZRO turn out to be the winner of this cycle after several months, then we could trace back and analyze the impact later.